INTERVIEWS

Continuing to receive stimulus and scale the business. What future does the up-and-coming insurtech company Sasuke envision from FINOLAB?

The use of digital technology in the insurance industry to improve operations and develop business, known as “InsurTech,” is showing significant growth. The insurance market, which brings peace of mind to our lives, is a massive market estimated to be worth 38 trillion yen for domestic life insurance alone. However, the state of digitalization within this market is considered to be lagging even within the financial industry.

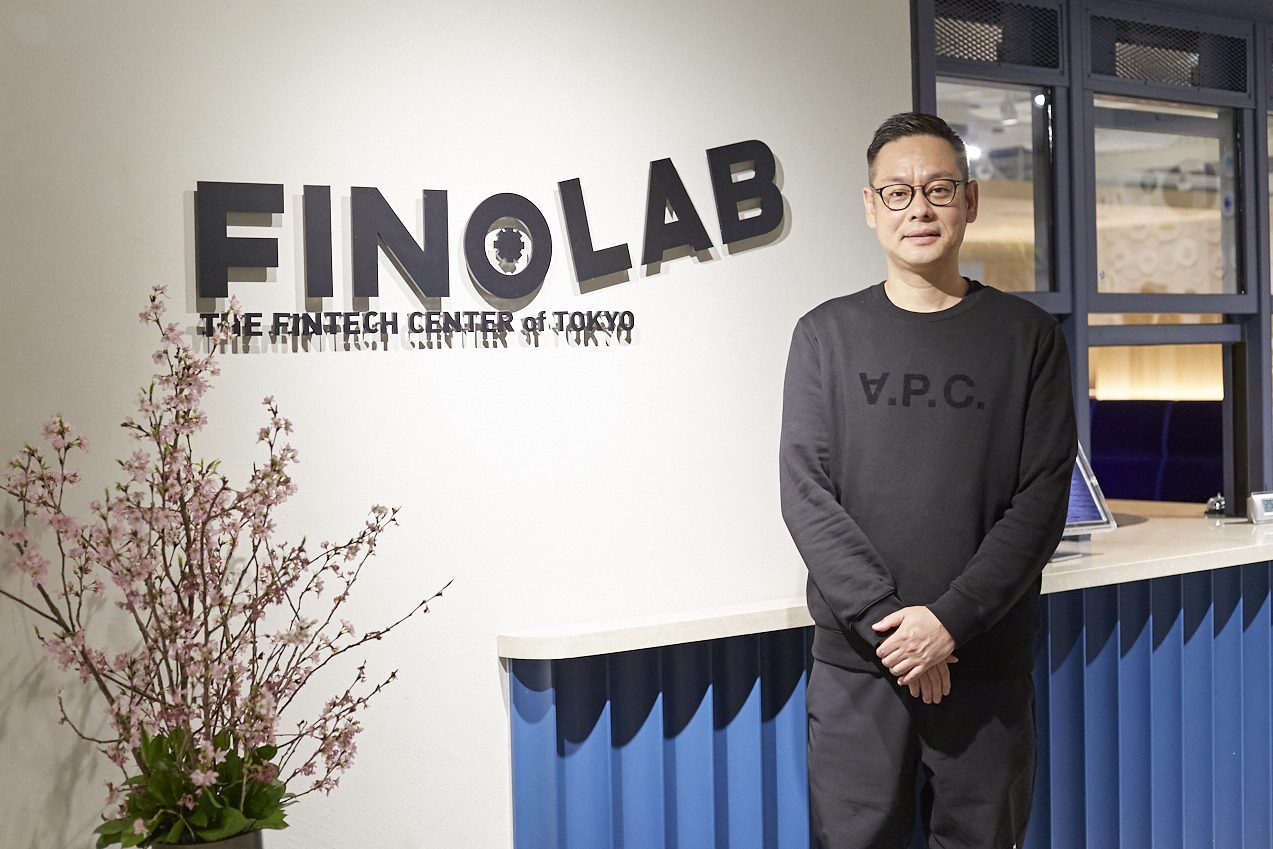

Founded in 2016, Sasuke Financial Lab Co., Ltd. (hereafter referred to as “Sasuke”) is a startup that believes in the future of insurtech and envisions a grand outlook. We spoke with the company’s CEO, Mr. Kiyotaka Matsui, about the challenges in the insurance industry, the potential of InsurTech, and the role that FINOLAB, where the company is currently based, plays in this context.

97–98% face-to-face. The reason insurance sales are analog

―Please tell us about your business.

We have set a mission to “transform Japan’s insurance industry through insurtech and realize a world where users can choose only the insurance they really need.” We offer a consumer-facing online insurance service called “Konohoken! (https://konohoken.com/)” and provide solutions related to marketing, creative services, and system development for insurance companies and insurance agencies.

What is common to both businesses is the goal of enabling consumers to choose the insurance that suits them best and allowing businesses to provide it, all through digital means. Since we established the company in 2016, we have consistently been working towards this goal.

In recent years, the digitalization of the financial industry has been accelerating. Digitalization in banking and securities has progressed significantly, with the adoption rate of online banking accounts steadily increasing. However, if we look at the insurance industry, 97–98% of life insurance products are estimated to be still sold face-to-face. It can be said that the insurance industry is the only sector within the financial industry where digital hurdles remain.

―Why do you think face-to-face sales are still so prevalent?

I believe that a major factor is that very few consumers are good at choosing insurance. For example, in the case of investments, even amateurs can choose and learn by buying stocks of companies they like or purchasing mutual funds related to themes they are interested in. Additionally, when purchasing a house or apartment, they can choose their loan options themselves.

However, when it comes to choosing insurance, the reality is that people only have the opportunity to sign a contract a few times in their lives. With dozens of types of insurance, such as life insurance and medical insurance, clearly understanding which insurance is optimal for oneself at that point in time is difficult.

Additionally, insurance is a product that prepares for unforeseen circumstances, but probably very few people continuously think about such events in their daily lives. That is why face-to-face interactions are effective for reminding people of the times when they might need insurance and drawing out their needs, as well as proposing products. It is also a field where digitalization is difficult to penetrate.

A world where you can choose the insurance that suits you

―What are the touchpoints between Sasuke and consumers?

Basically, consumers visit our online insurance service called “Konohoken!” where they can choose their insurance. The application itself is then completed on the insurance company’s site. Additionally, customers who wish for face-to-face consulting can meet with our in-house financial planners (FPs) to join an insurance plan. With the exception of special insurance for corporations, we cover almost all insurance products aimed at general consumers, including life insurance, property insurance, and medical insurance.

―here are other insurance comparison websites out there, but what are the differences with those?

There are three main features. The first one is the inclusion of “expert comments.” Each insurance product is accompanied by explanations, making it easier to understand the key points of the products.

The second feature is the reviews from other customers who have actually signed up for the products. These reviews provide insights into how the products performed when they were needed, making it easier to judge based on real consumer experiences.

The third feature is the provision of an “insurance robo-advisor.” By answering about seven to eight questions, the robo-advisor customizes and suggests the most suitable insurance for your current situation based on your responses.

― What prompts consumers to visit “Konohoken!” when choosing an insurance product, given that face-to-face sales account for 97–98% of the market?

As a major trend, not just for insurance but for purchasing products in general, consumers are increasingly searching the Web, researching, and comparing products before making a purchase. Insurance is no exception. Even in the case of face-to-face insurance sales, most consumers perform their research beforehand. This change in consumer behavior provides an opportunity for consumers to connect with our company, even in this industry that heavily relies on face-to-face sales.

Additionally, the timing for considering insurance varies for each person. Some might look for cheaper insurance when their current auto insurance reaches its expiration date, while others who have never been interested in insurance might start searching out of necessity. There are countless triggers for considering the purchase of an insurance product. In such situations, our service, which offers various proposal points digitally, is effectively capturing the diverse needs of consumers.

―Please tell us about your business for enterprises. Does Sasuke develop mechanisms such as digital contracts for consumers and provide them to insurance companies?

In our business for enterprises, known as BtoB, we support the digitalization of insurance companies by developing systems such as online application systems. By utilizing digital methods instead of face-to-face interactions in selling insurance, the revenue model for insurance companies is expected to undergo significant changes.

Japan is facing a declining population due to aging and low birth rates. Just as the number of consumers purchasing insurance is decreasing, the number of sales personnel selling insurance will also decline. However, even as the market shrinks, we believe it is possible to secure profits more than ever by transforming cost structures using the power of digital technology.

The merits of FINOLAB are “location,” “recognition,” and “resident companies.”

―What prompted you to found Sasuke?

The trigger for founding Sasuke started with my journey of graduating from a university in Los Angeles and joining Lehman Brothers. However, the company’s bankruptcy following the so-called Lehman Brothers’ collapse led me to move to Nomura Securities. It was at Nomura Securities where I was assigned to a project supporting the transformation of an insurance company into a corporation and its IPO, marking my initial connection with the insurance industry and deepening my understanding of it.

Subsequently, I transitioned to an asset management firm where I keenly realized the issue of “information asymmetry” surrounding financial products—specifically, the significant gap in information between those selling and those buying insurance. This realization strengthened my resolve to address this problem.

Meanwhile, around 2016, the term “fintech” was gaining popularity. There was a growing sense of expectation that challenges stemming from information asymmetry in fields like investments could be resolved through the use of digital technology. However, the insurance sector was still evolving, presenting a business opportunity that I felt compelled to seize. It was a time before the term “insurtech” even existed.

―Tell us about your decision to join FINOLAB shortly after starting your business.

first read articles related to FINOLAB and decided to inquire. At the time, shared offices themselves were still relatively rare, and our team consisted of only about three full-time members. It seemed like a perfect fit for us. Additionally, the idea of being in the “fintech hub” was quite appealing.

―Since moving into FINOLAB, you have moved from a shared office to a private room as you expanded your presence. What are the reasons for continuing to be housed at FINOLAB?

Firstly, location plays a significant role. Direct access to Otemachi Station is invaluable, especially since many of our clients in the insurance industry are based in Otemachi and Marunouchi. The high industry recognition of FINOLAB as a location adds to its appeal.

Moreover, the clustering of fintech-related companies here offers distinct advantages. Our team members frequently find inspiration and motivation from being surrounded by like-minded individuals.

FINOLAB also organizes regular insurtech meetups, which our team members and I actively participate in to foster networking opportunities. The rigorous screening process that FINOLAB employs for its resident companies is also important. Knowing that fellow residents share clear business themes and consist of trustworthy individuals is highly reassuring.

Continuous inspiration from the FINOLAB community

―FINOLAB has various features such as communities and funds. Have you used any of these services?

We had a corporate video produced for our website, featuring interviews with key members. During interactions with relevant parties, we learned that FINOLAB has video production capabilities. They responded to our request and delivered a highly satisfactory video.

―In my view, creating videos on themes like insurance or fintech can indeed be challenging due to the relative unfamiliarity of the industry.

そYes, you’re right. From the preparation stages, FINOLAB’s team members were present during meetings along with the production team and video creators. They facilitated communication and acted as a bridge throughout the process. I believe this kind of support is part of what makes FINOLAB so appealing.

―What are your expectations for FINOLAB in the future?

I hope to see more opportunities for business matching going forward. Even in the insurance industry, major companies are driving their own digitalization efforts. However, it feels like only a handful of companies have truly achieved this. There are still challenges regarding the speed of digitalization, and many companies are unsure where to start or what digitalization initiatives would be most effective. I would like to encounter such companies at FINOLAB and work together to address these challenges.

―Finally, please provide a message to startups considering moving into FINOLAB.

I believe the greatest value of FINOLAB lies in its gathering of companies and individuals sharing common themes like fintech and insurtech. In the shared space, discussions spanning various genres such as blockchain, securities, payments, insurance, and banking occur daily, providing immense inspiration. Here, you should find hints to scale your business. I strongly encourage you to join this community and become part of this network.

企業情報

Sasuke Financial Lab

- CEO

- Kiyotaka Matsui

HEAR MORE

-

JPYC Inc.

How Stable Coins Are Transforming Society: Innovation Envisioned by JPYC at FINOLAB

-

Ecrowd Inc.

“Ecrowd,” an equity crowdfunding that connects startups with individual investors. Taking full advantage of FINOLAB to design a “sustainable triple-win” world

-

luca.inc

Transforming conventional investment practices in Japan through the democratization of alternative investments: A closer look at LUCA’s vision for an “alternative investment platform from Japan”